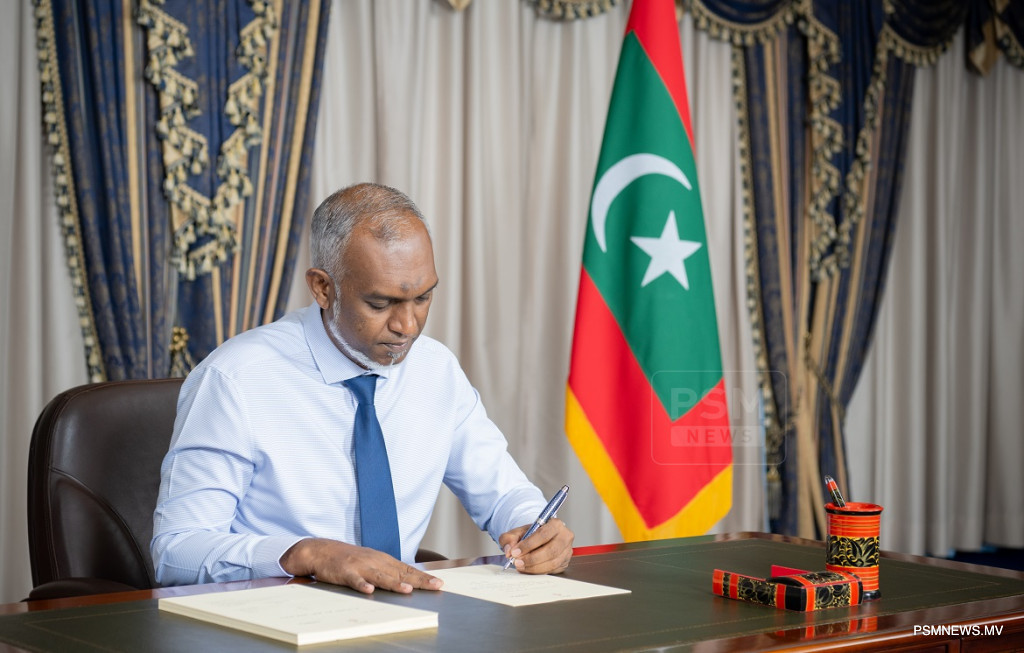

In a significant move to combat the escalating issue of drug trafficking, President Dr Mohamed Muizzu has ratified amendments to the Drugs Act, introducing the death penalty for individuals convicted of smuggling drugs into the Maldives.

The legislation, passed overwhelmingly by Parliament last week with 65 votes in favour, also imposes stringent penalties for drug importation, trafficking, and illicit enrichment.

The amendments, which stipulate the death penalty in cases involving possession of more than 350 grams of cannabis, over 250 grams of diformin, or more than 100 grams of other controlled substances. Crucially, the death penalty can be applied upon a person's entry into the Maldives if they are found to be smuggling drugs.

However, the application of the death penalty is subject to a unanimous verdict from a Supreme Court bench. Should the court not reach a consensus on capital punishment, offenders will face life imprisonment coupled with a hefty fine. The amended law also restricts the possibility of pardons or commutation for those sentenced to death or life imprisonment for drug smuggling, effectively barring parole for such individuals.

Additionally, the amendments aim to bolster the system for providing comprehensive treatment to drug addicts and facilitate their reintegration into society.

Beyond the severe penalties, the bill introduces measures to control novel psychoactive substances, introduce additional drug-related offenses and penalties, enhance drug addiction treatment programs, and review the operational rules of drug courts.

A notable provision within the amended Act, mandates the confiscation of property and money seized in connection with drug offenses, transfers this power from the State Finance Act to the court system. This will result in the forfeiture of assets utilised in or derived from criminal activities, including direct or indirect proceeds of crime.

Maldives Revises Benefits of Former Presidents

President Dr Muizzu has approved a legislative amendment, ushering in significant changes to the benefits and privileges afforded to the nation's past leaders and extending new provisions to former Vice Presidents.

Under the newly ratified law, the office expenses of former presidents will now be subject to deduction. Additionally, the financial benefits for a former president will be suspended if they are elected for a second term or assume any other public office. The act also stipulates that protection and security provisions are not required for former presidents during periods when they reside abroad.

A key inclusion in the amendment is the provision of protections and privileges for individuals who have served a full five-year term as Vice-President, as outlined in the Constitution. This package includes a monthly financial allowance of USD 1,945.53 and comprehensive state-funded healthcare. However, the legislation also introduces a critical caveat as neither a former President nor Vice-President shall be entitled to any of the protections and privileges under this Act if they are convicted of a criminal offense committed while holding office.

President Ratifies Zakat Bill

President Dr Muizzu has ratified the Zakat Bill to establish the legal framework governing the Zakat system in the Maldives, ensuring the effective organisation and regulation of the payment, receipt, and distribution of Zakat in order to fulfil the objectives prescribed in Islam.

With the entry into effect of this Act from 1 January 2026, a Zakat Fund will be established to safeguard Zakat contributions, distribute them to eligible beneficiaries, and invest the funds in accordance with Islamic Shariah. The Fund will be maintained in a dedicated account established with the Maldives Monetary Authority (MMA), separate from the public bank account, as determined by the Ministry of Finance and Planning. The MMA will serve as the custodian of the Zakat Fund.

Under the Act, the national Zakat policy, including the collection and distribution of Zakat assets, shall be determined by the President on the advice of the Minister responsible for matters relating to Islam. The President shall also establish a Zakat Council to advise the Minister and the Maldives Zakat House on the administration of the Zakat system.

A Shariah Advisory Committee, appointed by the President, will provide Shariah guidance and oversight in matters relating to the formulation and implementation of the Zakat system.

Maldives Offers Formally Recognition of Tourism Training Resorts

President Dr Muizzu has ratified the amendment to the Tourism Act to establish a legislative framework for leasing areas for tourist resort development and for the establishment and operation of Tourism Training Resorts, and to introduce the regulatory provisions required to support these developments.

The Amendment also provides for the extension of resort construction periods, defines lagoon boundaries for islands leased for tourism, and regulates the issuance of licences for tourism-related travel planning and management services.

A key feature of the Amendment is the formal recognition of Tourism Training Resorts as tourist facilities, with defined procedures for their lease, development, and management. It further stipulates that within inhabited islands or city jurisdictions, only tourist guesthouses or tourist hotels may be developed. Revenue generated for the State from such establishments must be allocated to the respective Island or City Council.

The Amendment also expands the scope for leasing islands, land, and lagoons to State-Owned Enterprises (SOEs). Companies in which the Government holds at least 45 per cent of shares are now eligible to lease land for the development of tourist resorts or integrated tourist resorts.

Additionally, the Ministry of Tourism and Environment has been authorised to defer rent payments for properties closed for redevelopment. This includes the authority to postpone rent and any fines accrued up to the date of closure, in accordance with relevant regulations.